The trends identified in this issue all point to the worthy goals of higher quality care delivery at lower costs. But one more trend stands to change much of the way healthcare stakeholders do business. That is consumer-directed healthcare (CDH), which is based on the principle that exposing individuals to the actual costs of care and granting them more responsibility in the decision-making process will empower them to apply market pressure via their wallets and help control costs.

Most-if not all-health plans have some sort of CDH product on offer. Typically these high-deductible offerings include some mix of health savings accounts, health reimbursement arrangements and flexible spending accounts as part of the package. But the configurations get complicated. And so, as opportunity knocks, a whole new market highly reliant on technology's ability to manage administrative and financial processes has sprung up. Some products are coming from managed care industry veterans such as Amisys Synertech (Rockville, Md.). But many are from newer entrants such as Canopy Financial (Chicago), CareGain (East Windsor, N.J.) and ReVolution Health Group (Washington, D.C.). Backed by some big names, including AOL Co-founder Steve Case and former Secretary of State Colin Powell, among others, Resolution Health Group was just launched in April 2005.

Financial firms are paying more attention to this sector, too. Although they've been slow to take stock of healthcare, interest in CDH dollars is enticing some big players. Among them is American Express (New York), which has introduced a card backed by American Express Bank and tied specifically to HSA fund management. This company has partnered with at least one major health plan (Wellchoice, New York) but has also introduced a consumer-focused card for individuals.

Adding a branding tool to the mix-aimed at boosting plan member loyalty and reducing the typically high churn rates-brings perks such as personal health records (PHRs) for members. Providers and payers all benefit from this tool, if it is configured to facilitate data sharing across the healthcare enterprise. Growing interest in this immature market is mirrored by the fast-growing number of vendors offering PHR products on smart cards, flash keys, as well as Web- and PC-based applications. At present, most companies aren't much interested in sales to individual consumers, preferring instead bulk sales to providers and payers.

Consumers are sure to like the convenience of provisioned PHRs, but there is high risk of consumer backlash if their records get trapped in a proprietary system when the individual changes provider or health plan. (For more on PHRs, see page 52)

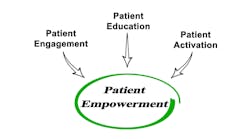

Most health plans subscribe to the goal of educating consumers so they can be more responsible regarding their care. However, few provide cost and quality information to enable members to make such informed decisions, according to findings of the Employee Benefit Research Institute/Commonwealth Fund Health Care Survey released in December. The survey concurs with a report released by RAND (Santa Monica, Calif.) in Sept. 2005 reporting that more cost-conscious consumers were also more likely to go without care-hardly a desirable result and counterproductive to the national focus on preventive care and wellness.

The CDH trend may well be an effective cost-containment strategy in the long term, but it's too soon to make the call. One thing is sure-helping consumers figure out the details is going to keep all stakeholders busy for a long while.