As the number of health information exchanges (HIEs) increases across the country, vendors that supply connectivity solutions are scrambling to meet the demand.

According to “Health Information Exchanges: Rapid Growth in an Evolving Market,” a report published in June 2011 by the Orem, Utah-based KLAS (www.KLASresearch.com), the number of live HIEs successfully exchanging data more than doubled between 2009 and 2010, and several hundred more are now in development.

One of the report's most surprising findings is the ratio of public to private HIEs, says Mark Allphin, clinical research director for health information at KLAS. “While the number of live public HIEs that KLAS was able to validate increased from 37 last year to 67 this year, the number of private HIEs that KLAS validated exploded from 52 to 160,” he says.

The report is based on interviews with 239 providers associated with 227 live HIEs; it does not include HIEs that were under development. The number of validated HIEs for each vendor should not be interpreted as that vendor's market share.

A vendor must have at least six validated live HIEs reporting to receive a performance score. On the other hand, to receive a ranking, the organization's product has to meet the minimum “KLAS Konfidence” criteria, Allphin explains. “We will not give a product a ranking until we talk to 15 organizations that use it.”

RISING TO THE TOP

Allphin observes that although there is a wide array of vendors serving this market, the cream is beginning to rise to the top.

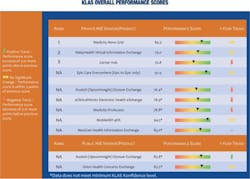

KLAS ranks Medicity Novo Grid as No. 1 in the private HIE sector, with an overall performance score of 84.3 out of 100. In the No. 2 spot is RelayHealth Virtual Information Exchange (79.0), followed by Cerner Hub, with a score of 70.8.

Two vendors that are well-regarded by those working predominately in a Cerner or Epic environment are Cerner, which has seen rapid growth in the private HIE market, with 21 validated HIEs, and Epic, which has 26 private HIE customers, and whose Care Everywhere scored a 92.9. Both companies are currently working on ways to connect to other vendors' systems, Allphin says.

In the public HIE solution space, Axolotl (OptumInsight) Elysium Exchange receives a performance score of 83.8, while Orion Concerto Exchange scores an 85.5. These two, however, are not ranked because they don't meet minimum KLAS Konfidence levels, Allphin says.

Medicity's rise to the top in this year's report reflects the attributes that providers say they need. “Medicity Novo Grid has simple architecture and is easy to plug in,” Allphin explains. The report also notes that Medicity has been in the HIE business longer than most vendors, and continues to be a market leader with 33 live private HIEs and five live public HIEs that are validated by KLAS. However, the recent acquisition of Medicity by Aetna has some customers concerned about the entry of payers into the HIE market, Allphin adds.

RelayHealth has grown from eight KLAS-validated live HIEs last year to 24 this year. The report's authors note that: “RelayHealth has seen substantial growth in the past year as they continue to leverage their portal/personal health record solution to help customers build viable HIEs. While some providers report some frustrations with interfacing and unmet expectations, others feel RelayHealth is a strong partner that is working hard to improve.”

The purchase of Medicity by Aetna is not the only indication that payers are now entering the HIE marketplace. UnitedHealth/Ingenix recently purchased Axolotl and renamed the company OptumInsight. Regardless, the newly branded vendor has 14 live public HIEs, more than any of its competitors, and is making a deep penetration into the private HIE market as well, with eight validated private HIEs, Allphin says.

CREATING A MEDICAL NEIGHBORHOOD

Dick Thompson, executive director and CEO of Grand Junction, Colo.-based Quality Health Network (QHN), has been satisfied with Axolotl's product and its customer/technical support. He hopes that does not change because of the buyout, but, he does believe the jury is still out.

Going live in October 2005, QHN now connects 640 active providers, and has more than 2,500 online users. Five hospitals are already connected, and two more are in the process of being added within the next 45 days, Thompson says, adding that four more hospitals have agreed to connect, with completion expected by early 2012.

The area served by QHN includes western Colorado and eastern Utah and it will eventually be connected to both statewide networks, Thompson says. But even after that happens, QHN's focus will remain local, he stresses: “Our founding organizations envisioned an all-inclusive non-profit, apolitical network focused on improving quality. Our focus was to create a medical neighborhood. The best return on investment is to create a locally driven HIE. I think that's the key, because healthcare is largely local.”

Driven mainly by physicians, a non-profit health plan, and acute-care facilities in the area that have contributed the initial $2.75 million in private funding, QHN chose Axolotl for its connectivity solution. “At the time, there wasn't anyone else that had proven they could do this work,” Thompson says.

According to Allphin, most HIEs still need to work on making their systems physician-friendly, both in ease of use and in delivering data where it's needed. “Among the live HIEs that KLAS validated for this report, only 43 percent were delivering patient data directly into physicians' electronic medical records [EMRs],” he says.

But that's not the case with QHN. “There are many EMRs that we interface with,” Thompson says, noting that participating providers can also use Axolotl's lite-version EMR, which does not include billing and scheduling, or opt for another vendor's “full-blown” EMR.

Although Thompson says that Axolotl's connectivity solution was “a great way to start,” and he values the system's ability to connect disparate systems, he acknowledges that his HIE is outgrowing its capabilities. “We're now moving more extensively into data warehousing and data mining, and this system is somewhat limited as it stands today,” he says. “We are in the process of soliciting for a ‘data layer’ that we can plug into the existing clinical messaging system so we can do more comprehensive analytics.”

QHN is not alone in seeking another vendor to add more layers of operability to its HIE. Among the findings of the KLAS study was that many HIE vendors still cannot offer every piece of technology that is needed, so providers often turn to vendors that can supply them with pieces like an enterprise master patient index, patient record locator, or central data repository.

MEETING CHALLENGES

While the need to expand a system's offerings is a logical step in the growth of an HIE whose mission is to share as much patient data as possible, not being able to transmit data directly to an EMR has become a major challenge, Allphin says.

The cost of interfaces is the biggest barrier, according to the KLAS report. In some cases, neither the provider nor the HIE is able nor willing to pay the high price demanded by EMR vendors.

Chris Henkenius, president of the Healthcare Technology Center at the Omaha, Neb.-based Bass & Associates Inc., is familiar with this challenge. His firm has assisted more than 30 states in building their HIEs and, by working with various vendors, has been involved in the implementation of private HIEs throughout the country. “Everyone wants the same thing: connectivity and the sharing of medical records,” he says. “But the biggest complaint is always the cost to the clinic or independent practitioner to connect to the HIE.”

EVERYONE WANTS CONNECTIVITY AND THE SHARING OF MEDICAL RECORDS. BUT THE BIGGEST COMPLAINT IS ALWAYS THE COST TO THE CLINIC OR INDEPENDENT PRACTITIONER TO CONNECT TO THE HIE. -CHRIS HENKENIUS

The second biggest barrier, according to the KLAS report, is that despite incentives available under meaningful use criteria, many clinics have not yet installed an EMR, so they have not had to deal with the challenges of interfacing with an HIE.

Many that do have an EMR are concerned about the integrity of data-including diagnoses-that can be pushed directly into that EMR by the HIE. “Some clinics want only certain types of data to be pushed in, while others want to keep HIE data completely separated from their own records,” the KLAS report states.

Getting physicians on board continues to be another major hurdle. Henkenius says that the faster you can get an HIE to the pilot stage, the better your chances for success. “As you begin to show value, others will come on board.”

Thompson likens the process to nuclear fission. “You have to have critical mass [of senders and receivers] coming together to sustain an HIE,” he says. Interestingly, the KLAS report found that among the providers interviewed, 37 percent said they measure the success of their HIE by the number of physicians that actually use the data.

In addition to getting data into an EMR, a recurring problem has been the disruption of physicians' workflow. “With that challenge in mind, more HIEs are striving for ways to deliver useful data to physicians without requiring them to leave their normal workflow, but so far progress has been slow,” the report states. Allphin adds that: “What we're told over and over is that if it's not put into the physician's workflow, it's harder to get adapted.” Thompson agrees: “It's all about clinical workflow,” he says. “It's about being able to adapt technology to enhance clinical workflow.”

The KLAS study also found that while many providers plan to eventually exchange data using continuity of care document (CCD) or continuity of care record (CCR) formats, most are a long way from achieving that goal. “In the 164 HIEs that KLAS validated for this study, 81 percent of the data was still being exchanged through basic Health Level [HL]7 interfaces, while only 12 percent was being exchanged using CCD/CCR,” Allphin says.

Thompson says that his HIE is still primarily using HL7-standardized interfaces, but is currently in the testing phase of parsing the CCD format.

With daunting challenges facing HIEs, dozens of large and small vendors have entered the market. Some may not survive, Allphin says. “There are a lot of small vendors, but how viable are they going to be in the long term? I don't know how the market can support 40 or 50 vendors.”

While HIEs in general are struggling to get usage up, the KLAS report concludes on a positive note: “If nothing else, the events of the past year seem to have established one thing: HIEs are not going away. As the U.S. healthcare market continues to evolve, HIEs will likely only increase in importance.”

Richard R. Rogoski is a freelance writer based in Durham, N.C. Healthcare Informatics 2011 November;28(11):30-34